The S&P 500 is a widely recognized index that tracks the performance of 500 large-cap U.S. companies across diverse sectors. Industry ETFs based on the S&P 500 provide investors with a targeted approach to invest in specific areas of the market, such as technology, healthcare, or energy. These ETFs offer diversification benefits and allow investors to allocate their portfolio according to their investment objectives.

For instance, if an investor believes that the technology sector will exceed expectations in the coming years, they could invest in a Technology Sector ETF that tracks the performance of S&P 500 companies in that industry. Similarly, investors interested in the development of renewable energy sources might consider investing in an Energy Sector ETF focused on clean energy companies within the S&P 500.

- Benefits of investing in S&P 500 Sector ETFs include:

- Spread of risk

- Specific sector concentration

- Ease of trading

It's important for investors to perform due diligence before investing in any ETF. Factors such as expense ratios, past performance, and the ETF's underlying holdings should be considered. By comprehending these aspects, investors can make informed decisions that align with their investment strategies.

Unlocking Performance: Analyzing S&P 500 Sector ETF Returns

Investors seeking to optimize their portfolio returns often turn to sector-specific ETFs that track the performance of selective segments within the S&P 500. By evaluating the recent returns of these ETFs, investors can gain valuable insights into market trends and identify attractive sectors for potential investment. A thorough review of S&P 500 sector ETF returns reveals key dynamics that can inform strategic portfolio allocation decisions.

- Factors such as monetary conditions, industry-specific influences, and geopolitical events can significantly affect the performance of individual sector ETFs.

- Comprehending these relationships is crucial for portfolio managers to make intelligent decisions about sector allocation within their portfolios.

Top-Performing S&P 500 Sector ETFs for 2023

Investors have been hunting capitalize on the opportunities within diverse industries of the S&P 500 in 2023. Several sector ETFs {have emerged|are shining as top performers, driven by strong market conditions and get more info factors. Look into these successful ETFs for significant portfolio exposure:

- Software

- Biotech

- Banking

- Energy

A diversified approach across industries can mitigate overall portfolio risk while {seeking|aiming for long-term growth. Consult a financial advisor to establish the best ETF allocation that aligns with your financial objectives.

Riding the Wave: Investing in S&P 500 Sector ETFs

The S&P 500, a bellwether of the U.S. economy, offers a plethora of investment avenues. By categorizing it into sector-specific Exchange Traded Funds (ETFs), investors can tailor their portfolios to leverage the growth potential of specific industries. Whether you're drawn to the disruption of technology or the durability of consumer staples, there's a sector ETF suited for your preferences.

- Balancing your investments across sectors can help mitigate risk and enhance overall portfolio performance.

Sector ETFs provide a visible way to gain exposure to defined industries, allowing investors to actively participate in market trends. As with any investment, it's crucial to undertake thorough research and appreciate the risks involved before dedicating your capital.

Sector Rotation Strategies with S&P 500 ETFs

A sector rotation strategy involves shifting your investments among different sectors of the market based on their outlook. Investors assume that certain sectors will outperform others during specific economic cycles. The S&P 500, a widely followed index that comprises 500 large-cap U.S. companies across various sectors, offers a versatile platform for implementing sector rotation strategies. By employing S&P 500 ETFs, investors can effectively obtain exposure to specific sectors.

- Such as, an investor may choose technology and consumer discretionary sectors during periods of economic prosperity.

- On the other hand, when economic slowdown looms, investors might allocate their investments toward defensive sectors such as utilities or healthcare.

It's important to note that sector rotation is a complex strategy and requires careful analysis. Investors should conduct thorough due diligence before implementing any sector rotation approach.

Unlocking Growth with S&P 500 Sector ETFs

Gain exposure to the broad U.S. market and mitigating risk by allocating individual sector ETFs based on the S&P 500 index. This type of ETF offers investors to hone in their portfolios on specific sectors, such as finance, benefiting potential growth in those areas. Through strategically picking sector ETFs that align with your financial goals, you can enhance returns and navigate market fluctuations with greater confidence.

- Consider the performance of different sectors before committing capital.

- Keep in mind that diversification across multiple sectors is key to managing risk.

- Stay informed to fine-tune your portfolio as needed.

Kelly McGillis Then & Now!

Kelly McGillis Then & Now! Jurnee Smollett Then & Now!

Jurnee Smollett Then & Now! Michelle Trachtenberg Then & Now!

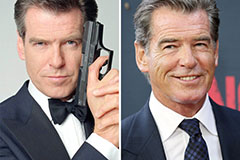

Michelle Trachtenberg Then & Now! Pierce Brosnan Then & Now!

Pierce Brosnan Then & Now! Kerri Strug Then & Now!

Kerri Strug Then & Now!